How to Finance a Franchise: 6 Simple Options to Expedite Your Franchise Journey

Owning a franchise can be your shortcut to small business success. You're set up with an established brand that provides access to a proven business model and ongoing business and marketing support.

Essentially, you're getting everything you need to run a profitable, sustainable business right out of the box.

In exchange, aspiring business owners may need to provide a significant investment at the beginning of their small business journey.

Figuring out how to obtain franchisor financing can be tricky. Still, many business loan options are available if you know where to look.

From bank loans and SBA loans to alternative financing options. We'll walk you through some common franchisor questions and give you seven cash flow ideas to get started.

Want to know how to open a franchise? Find out more here!

What is the cost of opening a franchise?

Every business needs working capital to get off the ground, and franchise costs will vary depending on the brand or industry. Franchise ownership costs start anywhere from $10,000 and can reach up to $1 million or more, depending on the type of franchise purchase.

It's a good idea to note that these franchise costs are separate from all of the usual business expenses like employee wages, office rental costs, insurance, and taxes. So you'll need to make sure you set cash aside for your franchise fee, royalty fees, and other things related to the day-to-day business operations.

How to finance a franchise with no money?

Some franchises can be purchased without an upfront payment, but at minimum, you'll probably need an excellent personal credit score in order to qualify for them. In reality, it's unlikely you'll be able to buy into a top franchise without a down payment.

Buying a franchise is the beginning of a business relationship. Your franchisor needs to see that you are serious about running a business under their name and have saved money for initial expenses or taken out a business loan. It shows you're worth the investment and know what it takes to become a business owner.

Can you get franchise financing?

The short answer? Yes, there are many financing opportunities that small business owners can use to purchase or start their businesses. We'll go through some of them below.

When looking for financing, it helps to assess your current financial situation. Even if you think you don't have what you need to start a franchise, certain assets in your bank account can put you in good standing with banks and other franchise loan providers.

Most financial institutions will look at your net worth and any personal assets you control to determine whether you qualify for financing. So listing your assets and subtracting any liabilities or payments owed will tell you your net worth.

First, go through your records and note down what you have:

- Cash on hand

- Stocks and bonds

- Equity in your 401(k)

- Other investments like real estate, automobiles, past businesses ventures, and other assets

How do you finance your first franchise?

Depending on your needs and budget, several lending sources can provide financial aid for your small business venture. It's worth noting that while traditional banks can often offer a commercial bank loan at a better interest rate, and the right conditions for your franchise funding, the application process is generally more difficult.

Here are some of the ways to get your franchise business up and running:

- Can your franchisor help with financing?

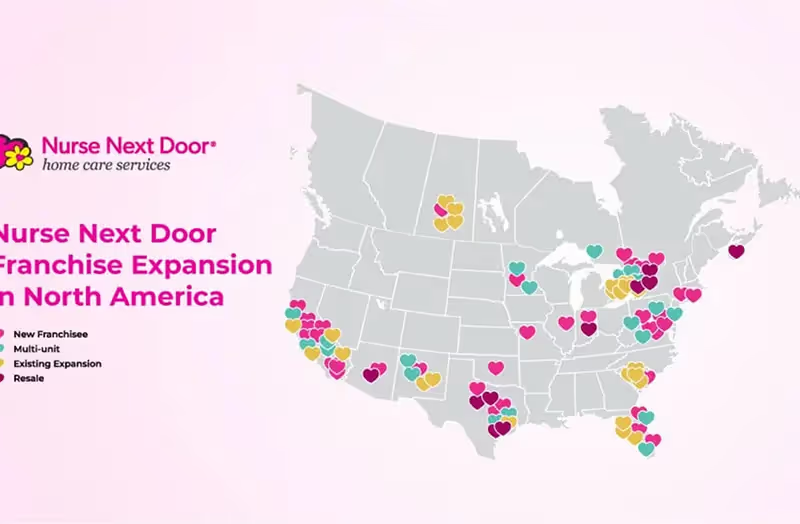

Franchisors are always on the hunt for new franchise owners to join their network. To ensure their franchisees are well-equipped from the beginning, they may offer in-house financing options to prospective franchisees. Essentially, this cuts out any financial middlemen and helps build a stronger relationship between the franchisor and franchisee.

Interested in starting up a home care franchise business?

Talk to Nurse Next Door today about financing options.

Often franchisors are happy to connect you with suitable lenders. However, having an existing franchise's "seal of approval" can go a long way toward being approved for a franchise loan itself.

Other ways to fund your franchise business

From government-approved SBA loans to alternative lenders, here are some franchise financing options for your new small business.

1. Will banks finance a franchise business? One common method of financing your franchise is through a commercial bank loan from a financial institution. Before approving small business loans, lenders will look at your financial history, business plan, and personal credit history. This helps them assess your creditworthiness.

They may look at your past income and how well you've been able to manage your income and pay off any debts. But if your past financials are not in top shape, don't panic. There are still ways to secure financing for your franchise.

For example, if you're dealing with a bank and have trouble securing a loan, you can propose obtaining an SBA loan which is guaranteed up to 90 percent by the Small Business Administration. More on this in the next section.

2. SBA Loan financing options: These loans are provided by lending institutions but with support from the United States Government.

The Small Business Administration funds an SBA loan through its intermediaries. Basically, SBA financing follows similar rules to traditional loan terms offered to business owners by banks. However, the SBA reduces the risks to lenders as it guarantees a portion of the total loan amount. The SBA sets all the criteria for loan approval and usually can guarantee up to 90% of the loan.

The franchise brand must appear in the SBA Franchise Directory to get these loans for a franchise business. In addition, potential franchise buyers can choose to apply for: SBA 7(a) loan program: which can be used for working capital, business expansions, finance real estate, equipment financing, and so on: SBA 504/CDC loan program: which has to be used for more specific reasons, such as buying property or fixing up equipment.

3. Friends and family loan options: When building a franchise, it's not uncommon to look to friends and family for help. They already know how committed you are to building a successful business and how credible you are as a business owner. If they believe in your small business, they might be willing to put money towards it. Whether offered as a loan or a gift, friends and family can give you good rates and benefits.

However, mixing business with family can sometimes lead to disputes down the road. When taking out a friend or family loan, it's important to treat it solely as a business transaction, taking any emotion out of the situation. You should make sure your contract includes repayment conditions and expectations.

Generally speaking, if all parties fully understand the contract, you'll unlikely face disagreements in the future.

4. Crowdfunding financing options: Another method of financing franchises for small businesses is crowdfunding. You could start and promote a crowdfunding website on the internet, or you could go to specific organizations that are interested in crowdfunding franchises. Planning and running a crowdfunding campaign can take time and money, so it's not for every entrepreneur. You also need to be aware that along with their contribution, your investors might also want a slice of the business pie.

5. 401(k) Business financing options: If you've always planned on using retirement savings, you can choose to roll your 401K or roll your business into a ROBS rollover. ROB rollover helps entrepreneurs access the income they've earned from retirement without paying any tax.

6. Alternative lender funding options: While we'd recommend trying to apply for an SBA loan or asking friends and family first, there are alternative lenders that are more than willing to fund your entry into the business world. An alternative lender can often offer more relaxed term loans or a line of credit to a potential franchise owner. Their interest rates can be as low as 9% but can rise as high as 99%, so it's important to always read the fine print before committing to anything. On the plus side, these alternative lenders can give you funding faster than traditional banks. If your application is accepted, you could receive funding in as little as 24 hours. Some alternative lenders and online lenders to watch out for are:

- OnDeck Capital

- CAN Capital

- Apple Pie Capital

Once you decide what kind of loan you need and what lender you want, you'll need to complete a credit request for a loan to qualify for franchise financing.

The documents you need will depend on how you want to obtain funding. For example, bank loans and SBA loans usually require personal credit and credit history checks. Often, if financing is offered, your minimum credit score is what makes you eligible to obtain financing terms.

2026 Tips to Speed Things Up

- Pick SBA-savvy lenders and CDCs that know your franchise. With the SBA Franchise Directory back, brands listed there can see smoother SBA processing. SBA+1

- Budget for fees using current notices. Confirm FY 2026 7(a) and 504 fees early so you’re not surprised at close; manufacturers may qualify for fee waivers in FY 2026. SBA+2SBA+2

- Lock your working capital. Even if you finance the franchise fee with 7(a), secure a line of credit for ramp-up—marketing, hiring, inventory—so you don’t starve the business. (Lender-specific.)

- Stay compliant if using ROBS. Follow IRS guidance to the letter (plan administration, valuations, payroll). IRS

- Underwrite yourself first. Lenders will—so build a clean personal financial statement, reduce revolving debt, and gather tax returns, pay stubs, bank statements, franchise agreement/FDD, and projections.

No Obligation Complimentary Call

Our Franchising Experts Have Answers to All of your Questions.

Recommended Reads

Why Nurse Next Door Is an Ideal Franchise Opportunity for Veterans

Explore why Nurse Next Door is a strong franchise opportunity for veterans, combining structure, leadership, and a mission-driven home care model.

Why Washington Is an Ideal Market for Purpose-Driven Home Care

Washington’s home care market is evolving as demand for aging-in-place continues to rise. Explore the opportunity, market dynamics, and what makes the right care model matter.

Why Nurse Next Door is One of the Best Home Care Franchises in 2026

Nurse Next Door is redefining what it means to own a home care franchise. Learn how our Happier Aging philosophy, 24/7 Care Services Center, and bold brand help owners build scalable, purpose-driven businesses in 2026 and beyond.

The Caring Journal

The Caring Journal is your go-to destination for stories, insights, and resources that celebrate the art and heart of caregiving.